RUNEBond – Risks, Lock-Ups and Why Easy Bonding Matters

RUNEBond enables delegated RUNE bonding on THORChain. Learn about liquidity lock-ups, slashing risk, and why easy RUNEBond access matters

RUNEBond is a core part of the delegated bonding model used to secure THORChain. Without enough bonded RUNE, node operators cannot remain in the active validator set, and the economic security of the network begins to weaken.

At the same time, RUNEBond is not risk-free. Bond Providers face limited liquidity, dependency on node operators, and full exposure to RUNE price volatility. Understanding these risks is essential before committing capital.

This article explains:

- the real risks users take when using RUNEBOND,

- why easy and transparent RUNEBOND access is critical for the long-term health of THORChain.

No Immediate Exit – The Core RUNEBond Liquidity Risk

The most underestimated risk of bonding RUNE is the lack of control over exit timing.

Delegated RUNE:

- cannot be withdrawn on demand,

- can only be unbonded once the node exits the active set.

In practice:

- the waiting period can range from a few days to more than six months,

- the decision to exit belongs to the node operator, not the Bond Provider,

- operators often exit at a user’s request – but this is not guaranteed.

For users, this means:

- no ability to react to market conditions,

- capital locked for an unknown period,

- reliance on a third party at critical moments.

➡️ This is a real liquidity and operational risk that must be understood before bonding.

Market Risk in RUNEBond – RUNE Price Decline During Lock-Up

Bonding almost always involves a long lock-up period, which significantly increases exposure to market volatility.

While bonded:

- RUNE cannot be sold,

- stop-losses cannot be used,

- strategies cannot be adjusted.

If during the lock-up:

- RUNE price drops significantly, or

- the market enters a prolonged downtrend,

then:

- bonding yield may not offset price losses,

- users remain locked in the position throughout the waiting period.

➡️ Bonding transfers full time and market risk to the Bond Provider.

Slashing Risk in RUNEBond Delegated RUNE Bonding

Another critical risk is slashing.

If a node operator:

- makes a technical mistake,

- behaves incorrectly,

- causes loss to the network,

then:

- a portion of bonded RUNE can be slashed,

- all Bond Providers of that node share the loss.

Importantly:

- RUNE Bond Providers do not control the operator’s actions,

- yet they fully share the consequences.

➡️ This makes operator selection and diversification essential.

Why Easy Bonding Matters at a System Level

From an infrastructure-builder’s perspective, one thing is clear:

bonding must be easy, transparent, and structured – or the system does not scale safely.

When bonding is complex or fragmented:

- fewer users participate,

- bond concentrates among a small set of operators,

- centralization and systemic risk increase.

When bonding is simple and accessible:

- more RUNE secures the network,

- more operators can compete for the active set,

- user error decreases,

- decentralization and resilience improve.

➡️ RUNEBond is not merely a UX improvement. It is a foundational security component of THORChain, aligning the incentives of bond providers, node operators, and the network into a single, scalable, and resilient system.

Bonding RUNE with RUNEBond – Full Benefits

RUNEBond is a delegated bonding solution within the THORChain ecosystem that makes bonding RUNE simple, secure, and accessible. It reduces operational risk, improves transparency, and enables both users and node operators to participate in network security efficiently.

Benefits of Bonding RUNE with RUNEBond

- Easy and anonymous communication – RUNEBond enables direct communication between bond providers and node operators directly from the wallet interface. No external tools are required, and full anonymity is preserved for both sides.

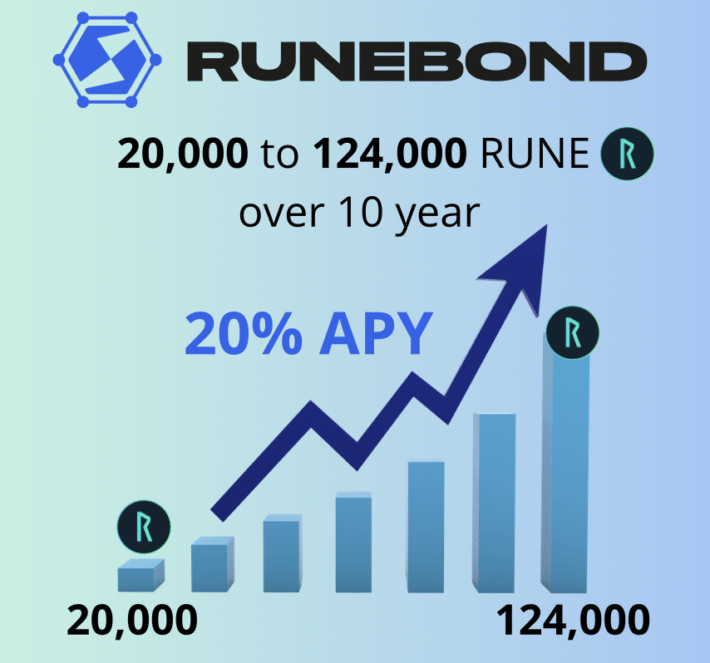

- Passive RUNE rewards – Bonded RUNE earns rewards passively. Users generate yield by helping secure the network, without active trading or portfolio management.

- Full control over funds – RUNEBond is non-custodial. Bond providers always retain full control over their RUNE at the protocol level, eliminating third-party custody risk.

- Reduced risk of delegation errors – Manual bonding can result in costly technical mistakes. RUNEBond automates the process, significantly reducing the risk of incorrect delegation.

- Lower entry barrier – RUNEBond makes bonding accessible to smaller RUNE holders, expanding participation beyond large capital providers.

- Better risk management – Users can diversify bonded RUNE across multiple node operators, reducing exposure to slashing or operator failure.

Benefits for Node Operators

- Simplified bond acquisition – RUNEBond allows node operators to attract bond providers organically through a streamlined and trusted bonding interface.

- Fee-based revenue – Operators earn predictable fee income from delegated RUNE, creating a sustainable operational model.

- Operational efficiency – Automation reduces manual communication, support overhead, and coordination errors.

- Faster node scaling – Easier access to bonding capital helps operators reach required bond levels and remain competitive in the active set.

Network-Level Benefits for THORChain

- Increased economic security – More bonded RUNE strengthens the economic security of the THORChain network and increases resistance to attacks.

- Reduced centralization risk – RUNEBond promotes a more even distribution of bonded RUNE across node operators.

- Long-term scalability – Simple and transparent bonding is essential for sustainable growth, decentralization, and resilience of the network

RUNEBond is more than a UX improvement. It is a core infrastructure component that aligns incentives between users, node operators, and the THORChain network enabling secure, decentralized, and scalable bonding.

Summary

RUNEBond is a core component of THORChain’s delegated bonding model and plays a direct role in the network’s security and stability. It enables non-custodial, delegated RUNE bonding, offering passive rewards and simplified participation in securing the network. At the same time, it introduces important risks, including limited liquidity, full exposure to RUNE price volatility, and slashing risk tied to node operator behavior.

Understanding both the benefits and the risks of RUNEBond is essential before committing capital. Easy, transparent, and well-structured bonding is not merely a user experience improvement it is a foundational requirement for long-term network security, decentralization, and scalability. By aligning the incentives of bond providers, node operators, and the network itself, RUNEBond forms a resilient and scalable security layer at the heart of THORChain.